A deposit given to secure the purchase of a home is usually used to compensate the seller if things go awry. But what if the buyer backs out of a deal and the deposit was never there in the first place? One Saskatoon couple says that happened to them, and now they are footing the bill for two homes.

Just weeks ago, the McNarlands had a 'sold' sign on their Willowgrove home. They were told by their real estate agent that the buyer had handed over a $10,000 cheque as a deposit. They were also told the buyer had financing approved to buy their home.

Coralee McNarland says seemed like a routine transaction. “On October 1, we got to put a sold sign on our house but what Sutton didn't realize was that cheque was NSF."

The $10,000 cheque bounced. Fearing the sale had fallen through, McNarland wanted to put the house back on the market, but their realtor assured them the money would come through. So, they moved into a rental home, hoping for the best.

“When that day came, they didn't move in, there was no money."

No sale means double expenses for the McNarlands. They are still paying the mortgage on their home, because it didn't sell. But now, they’re also paying the rent on their rental home, while waiting for their new home to be built in the spring.

“Now we're responsible for our mortgage and tips here, plus our rental and all of our bills over there, so coming into the Christmas season, as most are getting excited for Christmas, we're worrying about how we're going to make payments."

McNarland says the buyer's realtor should have been certain they had the cash in hand before carrying through the sale.

A complaint has not yet been made to the Saskatchewan Real Estate Commission; however, they will be investigating this matter.

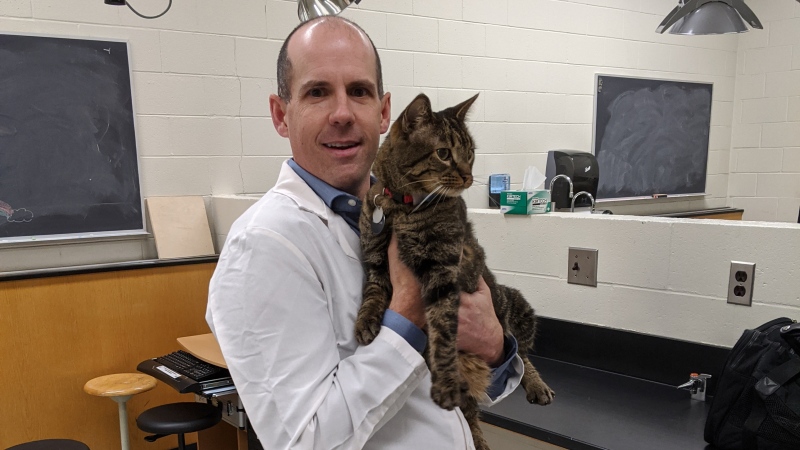

Aaron Tetu is with the Saskatchewan Real Estate Commission. Registrants in Saskatchewan are required to carry errors and omissions insurance to compensate those who can prove that they have suffered a loss or damage.

“If you have an offer that is presented to you that states that a certain amount as a deposit is being held in trust by one brokerage or another, if you have a contract that is signed and it states that, you should be entitled to rely on it.”

The McNarlands realtor from Century 21 declined to comment on camera, but in a statement says ‘this is an unfortunate situation that occurs once in a lifetime.’ He says legal action is being sought, and his team will work diligently with McNarland's to get what is owed them.

Sutton Realty, the buyer's representative, declined to comment.